How San Diego Home Insurance can Save You Time, Stress, and Money.

How San Diego Home Insurance can Save You Time, Stress, and Money.

Blog Article

Protect Your Home and Possessions With Comprehensive Home Insurance Coverage Coverage

Understanding Home Insurance Policy Insurance Coverage

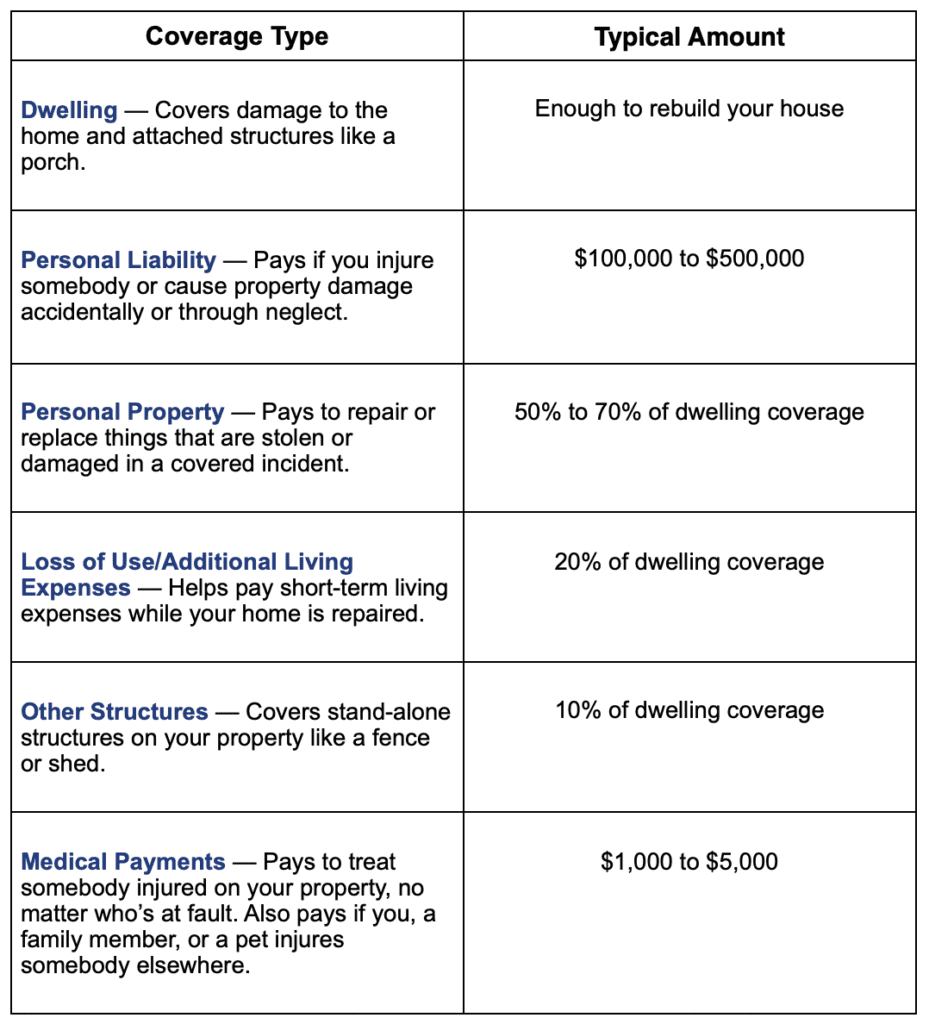

Understanding Home Insurance Protection is crucial for home owners to secure their property and assets in instance of unforeseen events. Home insurance coverage usually covers damage to the physical structure of your house, personal belongings, responsibility security, and extra living costs in case of a covered loss - San Diego Home Insurance. It is vital for house owners to grasp the specifics of their plan, including what is covered and left out, policy limits, deductibles, and any kind of additional recommendations or motorcyclists that may be needed based on their specific conditions

One key facet of comprehending home insurance protection is recognizing the distinction between actual cash value (ACV) and substitute price insurance coverage. House owners need to additionally be mindful of any type of insurance coverage limits, such as for high-value products like jewelry or art work, and consider buying extra protection if necessary.

Benefits of Comprehensive Policies

When discovering home insurance policy coverage, house owners can obtain a deeper admiration for the security and tranquility of mind that comes with comprehensive plans. Comprehensive home insurance policy policies use a vast array of benefits that go beyond fundamental coverage.

Furthermore, extensive plans often consist of insurance coverage for responsibility, providing protection in case someone is harmed on the residential property and holds the property owner liable. This liability coverage can assist cover medical expenses and lawful expenditures, supplying additional tranquility of mind for property owners. Moreover, comprehensive policies may also supply extra living costs insurance coverage, which can aid spend for temporary real estate and various other needed costs if the home ends up being unliveable because of a protected occasion. In general, the detailed nature of these policies supplies homeowners with durable security and monetary safety in various scenarios, making them a useful read this post here financial investment for protecting one's home and possessions.

Customizing Protection to Your Needs

Customizing your home insurance coverage to line up with your particular needs and her explanation circumstances ensures a reliable and customized securing approach for your property and properties. Customizing your protection allows you to resolve the one-of-a-kind aspects of your home and possessions, providing a more extensive shield against possible risks. Inevitably, customizing your home insurance protection offers tranquility of mind knowing that your properties are protected according to your special circumstance.

Safeguarding High-Value Assets

To effectively protect high-value possessions within your home, it is important to examine their worth and consider specialized insurance coverage choices that deal with their one-of-a-kind worth and importance. High-value properties such as art, fashion jewelry, vintages, and antiques may exceed the coverage limits of a basic home insurance coverage policy. It is important to function with your insurance service provider to make sure these things are appropriately secured.

One way to guard high-value properties is by arranging a different policy or endorsement specifically for these items. This customized coverage can provide higher protection limits and may additionally consist of additional defenses such as protection for unintended damage or mysterious loss.

Furthermore, prior to obtaining insurance coverage for high-value properties, it is a good idea to have these items skillfully assessed to develop their existing market price. This appraisal documents can aid streamline the cases process in the event of a loss and guarantee that you obtain the proper reimbursement to change or repair your valuable properties. By taking these positive actions, you can appreciate satisfaction understanding that your high-value properties are well-protected against unforeseen circumstances.

Claims Process and Policy Management

Verdict

In final thought, it is essential to guarantee your home and assets are sufficiently secured with comprehensive home insurance policy coverage. It is vital to prioritize the protection of your home and assets with detailed insurance policy protection.

One trick facet of comprehending home insurance protection is recognizing the distinction in between real cash money value (ACV) and substitute expense coverage. Property owners must also be conscious of any type of coverage limits, such as for high-value items like precious jewelry or art work, and take into consideration purchasing extra insurance coverage if essential.When checking out home insurance policy protection, home owners can get a deeper appreciation for the security and tranquility of mind that comes with extensive plans. High-value properties such as great art, precious jewelry, vintages, and antiques might go beyond the coverage limitations of a typical home insurance coverage policy.In final thought, it is vital to guarantee your home and properties are effectively shielded with extensive home insurance coverage.

Report this page